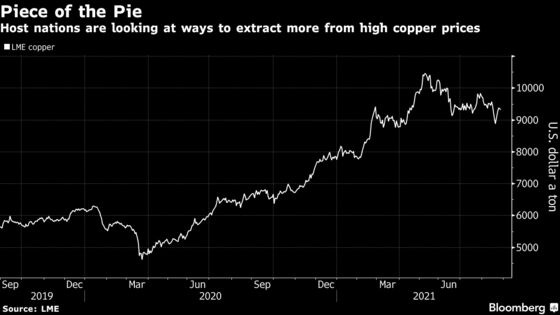

Copper Tips Today: Hit Full Target — A growing number of copper workers in top producer Chile are digging in for a bigger share of the metal windfall, increasing the prospect of further supply disruptions.

Just this week, a union at a mine owned by JX Nippon Mining & Metals and plant workers at Codelco’s Andina operation rejected new wage offers, opting instead to continue their strikes. A Cerro Colorado union urged members to snub BHP Group’s final proposal, describing it as “abusive,” and Codelco’s best offer to workers at its Salvador mine was labeled as “unacceptable” by the union.

There’s still time to prevent strikes at Cerro Colorado and Salvador, but the rhetoric suggests it will be a hard task. The four mines represent about 2.2% of global production. While one of the market’s biggest supply threats was neutralized earlier this month with a deal at BHP’s Escondida, talks are only just beginning at Codelco’s top mine, El Teniente.

For now, copper traders are focused on how the Federal Reserve intends to pare stimulus. But physical factors may come back into the spotlight at a time of tight supplies.

To be sure, brinkmanship, eleventh-hour deals and stoppages have characterized previous collective bargaining cycles in Chile, with Escondida hit with a 44-day strike in 2017. Producers can also limit the impact of industrial action by undertaking maintenance work. Codelco, for example, said Tuesday that it can still produce slightly more than last year despite disruptions at Andina.

सोशल मीडिया अपडेट्स के लिए हमें Facebook ( https://www.facebook.com/goldsilverreports/ ) और Twitter ( https://twitter.com/goldsilverrepor ) पर फॉलो करें।

हमारी फ्री सर्विस और लोगो की paid सर्विस से कई गुना अच्छी है।

आपको हर दिन दिए जाएंगे 3 से 5 कॉल बिलकुल फ्री

हर CALL में PROFIT दिये जायेंगे

तो जल्दी से MCX CHANNEL को JOIN कर लो (NEAL BHAI REPORTS)

JOIN US CLICK HERE

EQUITY CHANNEL को JOIN कर लो(EQUITY FREE TIPS)

JOIN US CLICK HERE

But the typical tensions of renewing contracts are being inflamed by the current highly profitable copper prices and Chile’s broad-based social justice movement that has plugged into an uptick in resource nationalism globally. Workers are also looking to be rewarded for their sacrifices in keeping mines operating during the pandemic. A bumper bonus package granted to Escondida workers caught the attention of other unions.

At the same time, companies are striving to keep labor costs in check in a cyclical business facing pricier inputs and falling ore quality. In the case of state-owned Codelco, there’s an added responsibility to feed state coffers at a time of increased spending on social services, with the company taking into account each mine’s productivity in wage talks.