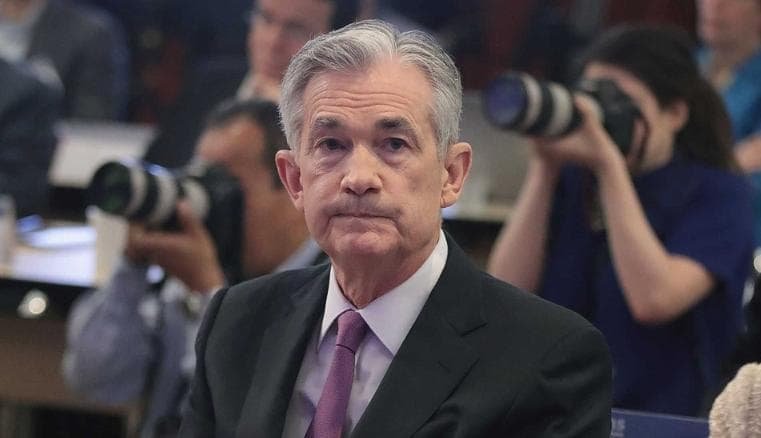

Gold Update: “Powell voiced a willingness to take rates beyond neutral in an effort to tame inflation, while sounding tone-deaf regarding economic worries given data is still robust for the most part.”

Gold Below $1842 Sell Sell Sell

(SELL ON RISE)

Read More: Silver Outlook: Silver Will Soon Drop For $19 | Neal Bhai Reports

“With downside momentum firming among the precious metals complex, and broad macro liquidations also weighing, we continue to see further downside potential for gold.”

“ETF holdings have fallen for a ninth straight day while positioning analytics still argue for the potential of additional pain for gold bugs.”

- Gold is trading with a negative bias on Wednesday after failing to get above its 200DMA on Tuesday.

- XAU/USD is currently in the $1810s and eyeing last week’s lows amid a buoyant buck and rising global yields.

A pick up in the US dollar as global markets adopt a slightly more risk-off tone and a Eurozone led rise in global yields is exerting pressure on spot gold (Yelow Metal) prices, which recently fell back to probe the $1808 per troy ounce mark. Hawkish remarks from Fed policymakers this week (including Chairman Jerome Powell on Tuesday) have emphasised the Fed’s commitment to inflation-fighting even in the face of weaker economic growth, while the ECB policymakers have been talking up the prospect of a summer start to rate hikes and this combo is weighing on stocks/pushing up global yields.

Higher yields raise the opportunity cost of holding non-yielding commodities like precious metals, hence the negative correlation to gold. Meanwhile, a stronger US dollar makes USD-denominated commodities like Yellow Metal more expensive for international buyers, also weighing on demand. Against the backdrop of a well-supported US dollar and hawkish central bank-inspired upside in global yields, many gold bears will be eyeing a test of last week’s lows in the mid-$1780s. Technicians noted that Tuesday’s test and rejection of the 200-Day Moving Average in the $1830s could prove an important bearish sign going forward. For now, the precious metal is stabilising in the mid $1810s, ever so slightly in the red on the day.

सोशल मीडिया अपडेट्स के लिए हमें

Facebook ( https://www.facebook.com/goldsilverreports/ )

linkedin (https://www.linkedin.com/in/nealbhai/ )

और Twitter ( https://twitter.com/goldsilverrepor ) पर फॉलो करें।

हमारी फ्री सर्विस और लोगो की paid सर्विस से कई गुना अच्छी है।

आपको हर दिन दिए जाएंगे 3 से 5 कॉल बिलकुल फ्री

हर CALL में PROFIT दिये जायेंगे

तो जल्दी से MCX CHANNEL को JOIN कर लो (NEAL BHAI REPORTS)

JOIN US CLICK HERE

EQUITY CHANNEL को JOIN कर लो (EQUITY FREE TIPS)

JOIN US CLICK HERE

” $ 1,813 पर बढ़ते ट्रेंडलाइन समर्थन के नीचे चार घंटे की कैंडलस्टिक को एक ब्रेकडाउन को सत्यापित करने के लिए आवश्यक है, $ 1,800 के निशान के लिए फर्श खोलना। अगला महत्वपूर्ण समर्थन $ 1,787 के बहु-महीने के निचले स्तर पर इंतजार कर रहा है।