U.S. Stimulus : Gold climbed to a one-week high as the dollar and real U.S. Treasury yields declined, with investors weighing prospects for a fast-tracked stimulus package in the U.S.

- Gold MCX Tips Today : Buy Gold For Target 49900—50800 SL Paid

- GOLD SILVER Dhanteras Special Trading Tips Rocking Gold Silver Pani Pani – Neal Bhai Hit

- Global Gold Prices Rise on Renewed US-China Trade Tensions

- Commodity Gold Report: Gold in Desperate Need of a Renewed Safe Haven Buying

- MCX Crude (Dec) Pani Pani All Target Done Watch Low 4017 – Fast Join Day Trading for Small Trader’s

U.S. Stimulus : President Joe Biden’s Covid-19 relief bill

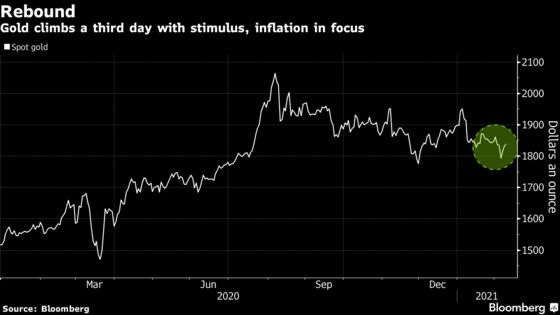

The metal climbed for the third straight day, the longest rally since Jan. 5, after Democrats released the first draft of key legislation that will comprise President Joe Biden’s Covid-19 relief bill. How much will stimulus checks be in 2021? Bets on a robust package of support are helping to underpin market-derived inflation expectations, which are at multiyear highs, and have fanned the so-called reflation trade. Gold pared some gains as the price approached a key resistance level.

- U.S. Junk-Bond Yields Drop Below 4% for the First Time Ever

- Does Bitcoin Mean ‘Better Gold’ or Bigger Bubble? QuickTake

- Goldman Says Bitcoin’s Surging Popularity Won’t Harm Gold

- Scaramucci Sees Huge Gains for Bitcoin in Comparison to Gold

- Novogratz Sees Bitcoin at $100,000, ‘Every’ Company Adopting

“It seems there’s some liquidation by traders as gold approached the 200-day moving average level,” Bart Melek, head of commodity strategy at TD Securities.

Spot gold advanced 0.3% to $1,836.49 an ounce at 2:51 p.m. New York time after reaching $1,848.60, the highest since Feb. 2. Futures for April delivery rose 0.2% to settle at $1,837.50 an ounce.

Platinum jumped as much as 2.8% to $1,194.13 an ounce, the highest since August 2016, amid an expected deficit this year.

Silver fluctuated, and palladium dropped. The Bloomberg Dollar Spot Index eased 0.5%.

“Rising breakevens and today’s dollar weakness will attract renewed interest back into gold and also silver, given the pull from rising copper and platinum prices,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “Speculators are carrying a light load in both gold and silver, but for now we need to see the yellow metal break the double top around $1,875 in order to attract renewed momentum.”

The frenzied rally in Bitcoin paused on Tuesday after prices hit a new all-time high of $48,000. Tesla Inc. said Monday it bought $1.5 billion of the cryptocurrency and its revised policies also permit gold investment.

Disclaimer

This article is intended for educational purposes only. The views and opinions expressed are those of individual analysts or brokerage firms and do not represent the views of GoldSilverReports.com. Investors are strongly advised to consult certified financial experts before making any investment or trading decisions.

| Follow us on |

| Telegram, Whatsapp , Facebook, Twitter, Instagram, YouTube, Google Business Profile and Truth Social. |