The Gold Silver Ratio stands at 81.5:1 as of September 2025, meaning you need 81.5 ounces of silver to buy one ounce of gold. This ratio currently sits 30% above its historical average of 60-65:1, suggesting silver may be undervalued compared to gold. For Indian investors, this presents a strategic opportunity as silver has delivered exceptional returns of 56% in 2025, outperforming gold’s impressive 49% gains. Understanding this ratio is crucial for optimizing your precious metals investment strategy and timing your entry and exit points effectively.

Understanding the Gold Silver Ratio: The Basics Made Simple

- 1 What Exactly is the Gold Silver Ratio?

- 2 How to Calculate the Gold Silver Ratio

- 3 🟡 Gold-Silver Ratio Calculator

- 4 Gold-Silver Ratio Calculator

- 5 Why This Ratio Matters for Indian Investors

- 6 Ancient and Medieval Periods

- 7 The American Standard Era

- 8 20th Century Volatility

- 9 21st Century: The Era of Extremes

- 10 Present Ratio Analysis

- 11 Indian Market Performance in 2025

- 12 Factors Driving Current Trends

- 13 The Classic 80/50 Rule

- 14 Mean Reversion Strategy

- 15 Extreme Level Trading

- 16 Three-Way Relationship Strategy

- 17 Portfolio Allocation Recommendations

- 18 Investment Vehicles Available in India

- 19 Tax Implications and Considerations

- 20 Economic Indicators

- 21 Industrial Demand Dynamics

- 22 Supply-Side Factors

- 23 Expert Predictions for 2025-2026

- 24 Long-term Trends to Watch

- 25 Potential Risk Factors

- 26 Conservative Investors

- 27 Moderate Risk Investors

- 28 Aggressive Traders

- 29 NRI Considerations

- 30 Common Mistakes to Avoid

- 31 Timing Errors

- 32 Strategic Missteps

- 33 Practical Oversights

- 34 Conclusion: Making the Gold Silver Ratio Work for You

What Exactly is the Gold Silver Ratio?

The Gold Silver Ratio is a simple yet powerful metric that shows how many ounces of silver you need to buy one ounce of gold. Think of it as a comparison tool between these two precious metals. For example, if gold costs ₹97,500 per 10 grams and silver costs ₹1,10,000 per kilogram, the ratio works out to approximately 88:1.

This ratio acts as a market indicator that helps investors understand which metal might be relatively cheaper or expensive at any given time. When the ratio is high, silver appears cheaper compared to gold. When it’s low, gold seems more attractive relative to silver.

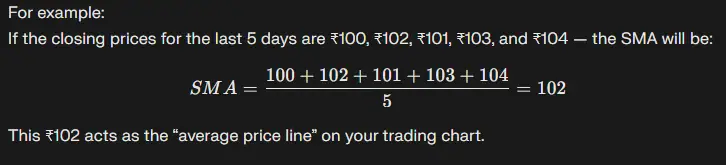

How to Calculate the Gold Silver Ratio

The Gold-Silver Ratio (GSR) is a simple but powerful tool for comparing the value of gold to silver. It tells you how many ounces of silver are needed to buy one ounce of gold.

🟡 Gold-Silver Ratio Calculator

Gold-Silver Ratio Calculator

📊 How to Use:

- High Ratio (e.g., 80–100): Gold is expensive relative to silver → Silver may be undervalued.

- Low Ratio (e.g., 40–50): Silver is expensive relative to gold → Gold may be undervalued.

- Traders use it to switch between gold and silver positions depending on which looks cheap.

⚡Tip: You can check live prices on sites like Kitco, Investing.com, or TradingView, then just divide gold’s price by silver’s price to get the ratio.

Why This Ratio Matters for Indian Investors

The Gold Silver Ratio serves multiple purposes for investors in India:

Market Timing: It helps identify when to buy or sell these metals. A historically high ratio suggests silver might be a better buy, while a low ratio might favor gold.

Portfolio Balancing: Indian investment experts recommend allocating 8% of your portfolio to gold and 15% to silver. The ratio helps fine-tune these allocations based on relative valuations.

Loan Leverage: With RBI allowing gold loans up to 75% LTV (Loan-to-Value), understanding the ratio helps optimize your borrowing strategy using gold as collateral.

Historical Journey: From Ancient Times to Modern Markets

Ancient and Medieval Periods

The Gold Silver Ratio has a fascinating history spanning over two millennia. During the Roman Empire, the ratio was officially fixed at 12:1. This meant 12 ounces of silver equaled one ounce of gold. This relatively tight ratio reflected the natural abundance of these metals in the Mediterranean region.

In medieval Europe, the ratio fluctuated between 9.4:1 in 1350 and 12:1 in the 1450s. The discovery of massive silver deposits in the Americas during the 15th and 16th centuries caused significant disruptions to this historical stability.

The American Standard Era

The United States government fixed the ratio at 15:1 with the Coinage Act of 1792. This official rate remained relatively stable for decades, providing monetary stability to the young nation. However, market forces eventually challenged these fixed ratios.

20th Century Volatility

The 20th century marked the beginning of extreme volatility in the Gold Silver Ratio. The average ratio for the entire 20th century was 47:1, but it experienced wild swings:

- 1930s-1940s: The ratio hit 90:1 during the Great Depression

- 1980: During the precious metals boom, it compressed to just 17:1

- 1991: It peaked at an extreme 98:1 when silver prices collapsed

21st Century: The Era of Extremes

The modern era has seen the ratio fluctuate between 35:1 and 124:1. Key milestones include:

2008 Financial Crisis: The ratio spiked to 83:1 as investors fled to gold’s safet

2011 Recovery: Post-crisis optimism pushed the ratio down to 31:1

2020 COVID Pandemic: Reached a modern record of 124:1 as gold soared while industrial demand for silver collapsed

Current Market Scenario: Where We Stand in 2025

Present Ratio Analysis

As of September 2025, the Gold Silver Ratio stands at 81.5:1. This level is significantly elevated compared to historical norms:

- 30% above the long-term average of 60-65:1

- 13% above the 10-year average of 81:1

- Well within the “silver-favoring” zone according to traditional trading rules

Indian Market Performance in 2025

The Indian precious metals market has witnessed extraordinary performance in 2025:

Gold Performance: Started the year around ₹60,000 per 10 grams and reached ₹97,500, delivering 49% returns

Silver’s Stellar Show: Beginning at approximately ₹75,000 per kilogram, silver soared to ₹1,10,000, posting an impressive 56% gain. This represents silver’s best annual performance in 10 years.

Historical Context: The last time silver delivered such spectacular returns was in 2020, when it rose 44% during the pandemic-driven precious metals rally.

Factors Driving Current Trends

Several key factors are shaping the current Gold Silver Ratio:

Central Bank Buying: Major central banks, particularly China and India, have been accumulating significant gold reserves. China alone purchased 15 tonnes of gold in late 2024.

Industrial Demand for Silver: Unlike gold, 52% of silver demand comes from industrial applications. The clean energy revolution, particularly solar panels and electric vehicles, is driving unprecedented industrial demand.

Geopolitical Tensions: Ongoing global uncertainties continue to support gold prices as a safe-haven asset.

Smart Trading Strategies Using the Gold Silver Ratio

The Classic 80/50 Rule

The most popular strategy among precious metals investors is the “80/50 Rule”:

- When the ratio exceeds 80: Consider buying silver (as it appears relatively cheap)

- When the ratio falls below 50: Consider buying gold (as it becomes relatively attractive)

- Between 50-80: Hold your existing positions steady

This strategy has shown a success rate of 70-75% when implemented with proper risk management.

Mean Reversion Strategy

This approach focuses on the ratio’s tendency to return to its historical average:

- Buy silver when the ratio is above 65 (long-term average)

- Buy gold when the ratio is below 65

- Rebalance positions as the ratio approaches the mean

Historical data shows this strategy achieved a 72% success rate between 2011-2020.

Extreme Level Trading

For more aggressive traders, extreme ratio levels offer high-probability opportunities:

- Ratio above 90-100: Heavily favor silver positions

- Ratio below 40: Concentrate on gold investments

- Success rate at extremes: Up to 85%

Three-Way Relationship Strategy

Advanced investors employ strategies involving gold, silver, and copper to capitalize on their different properties:

- Gold: Pure monetary metal (safe haven)

- Silver: Hybrid industrial/precious metal

- Copper: Pure industrial metal

This approach exploits silver’s “impurity” as both an industrial and precious metal.

Indian Investment Context: Practical Applications

Portfolio Allocation Recommendations

Financial experts suggest optimal allocations for Indian investors:

- Gold allocation: 8% of total portfolio

- Silver allocation: 15% of total portfolio

- Total precious metals exposure: 5-10% for optimal diversification

Investment Vehicles Available in India

Physical Gold and Silver: Traditional approach offering tangible ownership but requiring secure storage and insurance

Gold and Silver ETFs: Trade like stocks with expense ratios ranging from 0.5-1% annually. Offer high liquidity and transparency without storage hassles

Sovereign Gold Bonds (SGBs): Government-backed securities with interest payments and tax benefits. Unfortunately, no new tranches are being issued currently

Digital Gold and Silver: Platforms like eBullion allow investments starting from ₹100, making precious metals accessible to small investors

Gold Monetization Scheme: Allows depositing idle gold with banks to earn interest

Tax Implications and Considerations

Physical Metals: GST applicable, plus making charges and storage costs

ETFs: More tax-efficient for investment purposes

SGBs: Capital gains tax exemption if held till maturity

Key Factors Influencing the Gold Silver Ratio

Economic Indicators

Inflation Trends: Both metals serve as inflation hedges, but gold typically responds more strongly to monetary debasement

Interest Rates: Federal Reserve rate cuts signal strong growth outlook for gold. Lower rates reduce opportunity cost of holding non-yielding assets

Currency Movements: The ratio correlates strongly with the US Dollar Index. A weakening dollar typically favors both metals but affects silver more due to its industrial component

Industrial Demand Dynamics

Silver’s industrial applications create unique price dynamics:

Clean Energy Revolution: Solar panels and electric vehicles are driving unprecedented silver demand. The Silver Institute forecasts demand to exceed supply for the next 5 years

Electronics and AI: Consumer electronics growth and AI development increase silver consumption

Medical Applications: Silver’s antimicrobial properties drive medical and water purification demand

Supply-Side Factors

Mining Production: Gold mining output remains relatively stable, while silver faces production challenges

Central Bank Policies: Central banks buy over 1,000 tonnes of gold annually but don’t purchase silver, creating fundamental demand differences

Recycling Patterns: Different recycling rates affect the available supply of both metals

Future Outlook: What Lies Ahead

Expert Predictions for 2025-2026

Gold Price Targets: Analysts expect gold to potentially reach $2,950 per ounce by late 2025

Silver Price Projections: Silver could reach $35-40 per ounce, supported by industrial demand

Ratio Expectations: The ratio could decline to 70:1 by 2025, closer to historical averages

Long-term Trends to Watch

Industrial Silver Shortage: A deficit of 750 million ounces over four years supports higher silver prices

Central Bank Gold Accumulation: Continued central bank buying, especially from emerging markets

Renewable Energy Boom: 20% of global silver now goes to renewable energy projects

Potential Risk Factors

Economic Recession: Could temporarily boost the ratio as investors flee to gold

Industrial Slowdown: Reduced manufacturing could dampen silver demand

Monetary Policy Changes: Unexpected central bank actions could disrupt current trends

Investment Strategies for Different Risk Profiles

Conservative Investors

For risk-averse investors focusing on wealth preservation:

- Maintain core positions in both metals regardless of ratio fluctuations

- Use ratio extremes for minor rebalancing (10-20% of holdings)

- Prefer physical gold and silver ETFs over aggressive trading strategies

- Focus on long-term wealth protection rather than short-term gains

Moderate Risk Investors

Balanced approach combining stability with growth:

- Implement the 80/50 rule with disciplined execution

- Allocate 70% to core holdings, 30% to ratio trading

- Use systematic investment plans (SIPs) in precious metals ETFs

- Monitor ratio monthly and rebalance quarterly

Aggressive Traders

For those comfortable with higher volatility:

- Actively trade ratio extremes above 90 and below 40

- Use futures and options for leveraged exposure

- Implement three-way strategies involving copper

- Monitor ratio daily and execute rapid position changes

NRI Considerations

For Non-Resident Indians:

- Gold and silver ETFs offer best accessibility without physical storage challenges

- Consider currency hedging when investing from foreign earnings

- Understand tax implications in both resident and Indian contexts

- Use international precious metals platforms for broader access

Common Mistakes to Avoid

Timing Errors

Chasing Extremes Too Early: Just because the ratio seems high doesn’t mean it can’t go higher

Ignoring Transaction Costs: Storage, insurance, and transaction costs can significantly impact returns

Over-leveraging: Using too much borrowed money in volatile precious metals markets

Strategic Missteps

All-or-Nothing Approaches: Putting entire precious metals allocation into one metal based on ratio alone

Ignoring Fundamental Trends: Focusing solely on ratio without considering underlying supply-demand dynamics

Short-term Thinking: Expecting immediate mean reversion when ratios can stay extreme for extended periods

Practical Oversights

Storage and Security Issues: Underestimating costs and risks of physical ownership

Tax Planning Negligence: Not optimizing for tax-efficient investment structures

Liquidity Assumptions: Assuming all precious metals investments offer same liquidity

Conclusion: Making the Gold Silver Ratio Work for You

The Gold Silver Ratio at 81.5:1 in September 2025 presents a compelling case for silver investments. With the ratio sitting 30% above historical averages and silver delivering its best performance in 10 years with 56% gains, the current market dynamics favor the white metal.

However, successful ratio-based investing requires patience, discipline, and proper risk management. The ratio’s historical tendency to mean-revert offers opportunities, but timing these movements precisely remains challenging.

For Indian investors, the current environment offers multiple pathways to precious metals exposure. Whether through ETFs for convenience, SGBs for tax benefits, or physical metals for psychological comfort, the key is maintaining appropriate allocations and using the ratio as one of several decision-making tools.

Remember: The Gold Silver Ratio is a powerful indicator, but it works best when combined with fundamental analysis, technical indicators, and a clear understanding of your investment goals. As markets continue evolving with industrial demand for silver growing and central banks accumulating gold, staying informed about these dynamics will help you make better investment decisions.

The current elevated ratio suggests silver may offer better value relative to gold, but always invest within your risk tolerance and maintain proper diversification across asset classes. The yellow metals market rewards patient, well-informed investors who understand both the opportunities and risks inherent in ratio-based strategies.