Fed FOMC Meeting Minutes: Investors gauging the likely size of the Federal Reserve’s interest-rate hike in March and plansfor shrinking a balance sheet now at a record $8.9 trillion will get fresh clues on Wednesday.

Chair Jerome Powell told reporters

That’s when the Fed publishes minutes of last month’s policy meeting, where Chair Jerome Powell told reporters the U.S. centralbank is on track to raise rates for the first time since 2018 and officials also shared general principles for normalizing their balance sheet. The minutes willbe released at 2 p.m. in Washington.

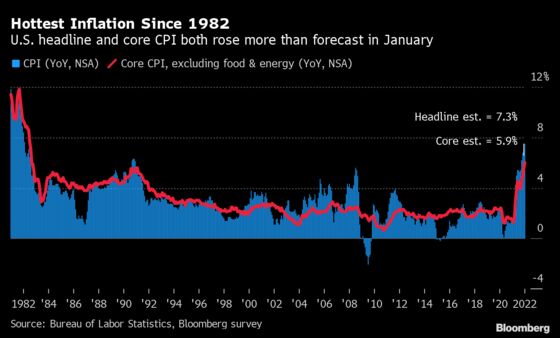

Officials are pivoting toward fighting the hottest inflation in 40 years andremoving the massive support they deployed to protect the economy from Covid-19. That’s prompted speculation that they may act more aggressively to get price pressures back under control, with some betting on a half-point move, which would be the first increase of that scale since 2000.

Discussion of 50 basis points

“If there wassome discussion of 50 basis points, we may get a very oblique reference to it in the minutes,” said Andrew Hollenhorst, chief U.S. economist at Citigroup Inc.. “You might get a statement of the pros andthe cons. That keeps it alive for the March meeting. The minutes could sound a bit hawkish if there was some discussion.”

While the minutes could show that a 25 basis-point move was viewed in January as the most likely course, they could hint at conditions under which the Fed might consider something larger, he said.

What Economics Says…

“Whether the FOMC committee has an appetite for a 50-basis point hike in March — as markets now have priced in — will depend on members’ and Fed staff’s assessment of the urgency of the inflation outlook, and whether the Fed is “behind the curve.” The January FOMC minutes may provide clues to that, and explain why Fed Chair Jerome Powell gave such a hawkish post-meeting presser.”

Inflationary pressures have accelerated since officials met last month, with consumer prices rising 7.5% in January from a year ago, while both U.S. employment and wages have surged. Policy makers will see another inflation and jobs report before their March meeting.

Federal funds rate at around 2.5%

With the FOMC estimating the long-run neutral level of their benchmark federal funds rate at around 2.5%, the minutes could give a sense of the urgency the committee felt in getting it up there — from near zero currently — even before the latest inflation news.

“Inflation is the number-one concern and number-one priority,” said Aneta Markowska, chief financial economist at Jefferies LLC. “Everybody knows that the Fed is behind. The question is how quickly do they intend to catch up to an appropriate policy stance.”

FOMC Forecast 2022

Markets are now pricing in six or seven quarter-point moves by the end of 2022, including the possibility of a 50-basis point hike in March. The FOMC forecast just three quarter-point hikes in its last projections in December. Powell, in his post-meeting January press conference, declined to rule out a 50-basis point hike.

Balance Sheet

With its other monetary policy tool, the Fed is currently scheduled to end its asset-purchase program in early March, ahead of the policy meeting. Powell said discussions over shrinking the balance sheet — which some investors call quantitative tightening — will be held at upcoming gatherings.

“We need to hear details from the Fed on how they are going to do QT and we need to hear them soon,” said Mark Holman, a partner at TwentyFour Asset Management, a London-based investment firm that specializes in fixed-income securities.

“The case for the Fed to do something quickly is growing day by day, especially given how disappointing the recent inflation report was,” said Holman, who thinks the Fed should sell some of its long-term Treasuries to help prevent the yield curve from inverting.

In a January statement, the Fed said it expects the process of balance-sheet reduction will commence after it has begun raising rates. It also spelled out that it planned to “significantly” shrink the balance sheet over time, while in the longer run holding mainly Treasury securities, implying a desire to shed most of the $2.7 trillion of mortgage-backed securities that it also currently owns.

Powell said no decision was taken at the January meeting on the pace of the runoff or when it would start.

At least two officials — St. Louis Fed President James Bullard and Kansas City Fed chief Esther George — have since raised the possibility of selling assets in the future. Officials haven’t disclosed details of how much runoff would be targeted in the initial months or what the size of the balance sheet should be longer term.

Last time they shrank the balance sheet, official set caps to govern how much of their maturing securities would be allowed to run off every month and how much would be reinvested to ensure the process would be gradual.

“I would love to see some actual specifics on cap sizes and methodology. And balance between” mortgage-backed securities and Treasuries, said Blake Gwinn, RBC Capital Markets strategist.

FOMC Minutes Outlook 2022

- The FOMC Meeting Minutes tend to counter the tone set in the meeting.

- Contrary to the original hawkish message, doves may have the upper hand in the document.

- Lower rate hike expectations may weigh on the dollar, boosted by strong US data.

The decision giveth, the minutes taketh away – while protocols from the Federal Reserve’s meeting minutes are tailored to send markets a message, they also have a clear record in surprising markets with a tone that is different from the messages conveyed at the post rate decision stance.

In September, November and December 2021, Fed Chair Jerome Powell was relatively dovish in official testimonies, public appearances, and press conferences referred to earlier. Hawks in the central bank made themselves heard in various interviews but seemed to fade to the shadows around the Fed’s decisions.

However, those hike-happy officials leaped back to the forefront in the meeting minutes, supporting a faster pace of rate increases a quicker beginning to tapering bond buys – or a faster end to that process. This time, the same logic may apply, but in favor of the doves.

Meeting Minutes background

The upcoming release refers to the January 26 2022 meeting, in which Powell expressed surprisingly hawkish views. He refused to rule out raising rates by a double dose of 50 bps in March, left the door open to hiking borrowing costs at every meeting, and also allowed for a fast sell-off of bonds the bank accumulated.

Since then, data has supported his views. The economy gained 467,000 jobs in January, triple the early estimates and inflation hit yet another 40-year peak at 7.5% YoY last month.

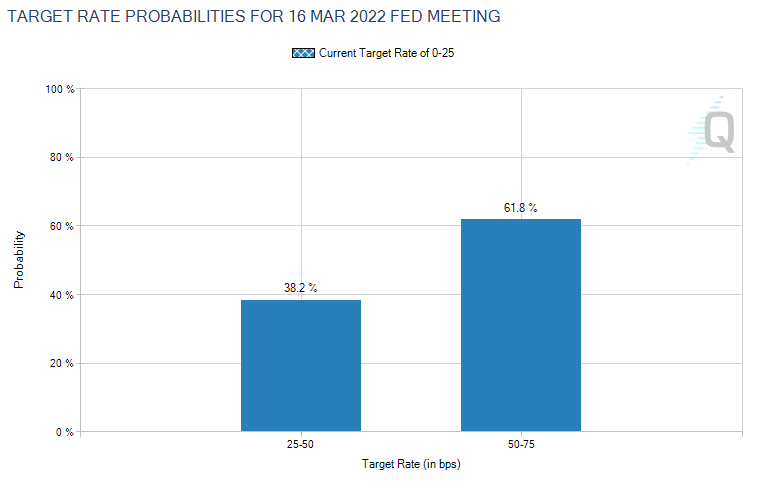

That has been enough to convince markets that a double-dose rate hike has better chances than a standard 25 bps move in March. Here is what bond markets reflect:

However, some of his colleagues – such as Atlanta Fed President Raphael Bostic – have been playing down the chances of a 50 bps rate move in March. Even St. Louis Fed President James Bullard – at the extreme end of the hawkish spectrum – does not see an initial strong move as a necessity.

That implies markets are overpricing the Fed’s rate hike cycle. The meeting minutes could reflect a calmer stance. Such a more data-dependent approach would push expectations lower and drag the greenback down with it.

Final Conclusion

Apart from the Fed’s tendency to balance its message in the minutes, the world’s most powerful central bank is also mindful of what happens on Wall Street. While taking the froth out of tech stocks could be seen as a much-needed repricing, a broad bear market s undoubtedly something the Fed would like to avoid. That is another reason to send a soothing message.

FAQs:

The minutes will be released at 2 p.m. in Washington. Officials are pivoting toward fighting the hottest inflation in 40 years and removing the massive support they deployed to protect the economy from Covid-19.

Minutes from the Federal Open Market Committee meeting will be released at 2 p.m. in Washington on Wednesday. Forecasts from Fed officials in the “dot plot” published alongside the policy statement showed the expectation for three quarter-percentage-point increases in the key federal funds rate target in 2022.

FOMC (Federal Open Market Committee) is the branch of the United States Federal Reserve that determines the course of monetary policy. FOMC announcements inform everyone about the US Federal Reserve’s decision on interest rates and are one of the most anticipated events on the economic calendar.

Minutes are an official record of actions the board or committee took at a meeting, not a record of everything that was said. They serve a historical purpose, but just as important, they serve a legal purpose, documenting the group’s adherence to the proper procedures and the association’s bylaws.

सोशल मीडिया अपडेट्स के लिए हमें

Facebook ( https://www.facebook.com/goldsilverreports/ )

linkedin (https://www.linkedin.com/in/nealbhai/ )

और Twitter ( https://twitter.com/goldsilverrepor ) पर फॉलो करें।

हमारी फ्री सर्विस और लोगो की paid सर्विस से कई गुना अच्छी है।

आपको हर दिन दिए जाएंगे 3 से 5 कॉल बिलकुल फ्री

हर CALL में PROFIT दिये जायेंगे

तो जल्दी से MCX CHANNEL को JOIN कर लो (NEAL BHAI REPORTS)

JOIN US CLICK HERE

EQUITY CHANNEL को JOIN कर लो (EQUITY FREE TIPS)

JOIN US CLICK HERE

Spot gold trades with gains around $1,863 a troy ounce, recovering amid a souring market’s mood. A pinch of optimism could be seen during European trading hours, but it ended up fading after Wall Street’s opening.

Believe the yellow metal has potential to reach the November high of $1,877 and even the $1,902——$1,918 area.

Update: The price of the yellow metal is going and froing between the day’s range of $1,850 and $1,870 but threatens a breakout to the top side ahead of the Federal Open Market Committee minutes. However, gold bulls are unlikely to find any fuel from those if they are as hawkish as the markets expected them to be. Bets on front-loaded Fed tightening should help to limit any further losses in the greenback that has otherwise suffered a bout of risk-on in financial markets. This is down to the market’s perception that there is less of an imminent threat of a Russian invasion of Ukraine that had been touted in the media to happen today.

On the contrary, Russia had said it had pulled troops away from the border of Ukraine, but there is no Western or Ukrainian intelligence on this. This leaves markets on edge. The White House press secretary Psaki has said that there is still in window where an attack could come at any time by Russia and one that could be preceded by a false flag, and misinformation as a pretext.