Federal Reserve Outlook: The Federal Reserve (Fed) is expected to leave its policy rate unchanged at the range of 5%-5.25% on Wednesday, June 14, 2023 at 18.00 GMT.

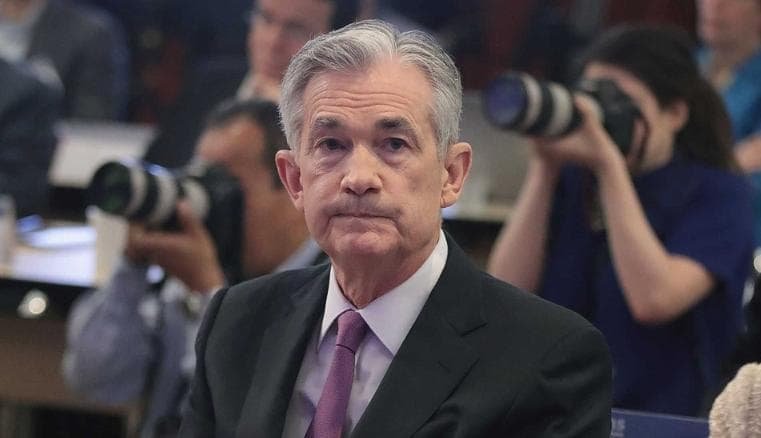

The Fed will release the revised Summary of Economic Projections (SEP), the so-called dot plot, and FOMC Chairman Jerome Powell will comment on the policy decisions and economic outlook in the post-meeting press conference.

- Federal Reserve is widely expected to leave its policy rate unchanged at 5-5.25%.

- Fed will publish the revised Summary of Economic Projections in June.

- US Dollar valuation could be impacted by dot plot and FOMC Chairman Powell’s comments.

The market positioning suggests that a no change in the Fed’s policy rate is nearly fully priced in, especially after the data from the US showed that the Consumer Price Index (CPI) rose 4% on a yearly basis in May, down sharply from the 4.9% increase recorded in April. According to the CME Group FedWatch Tool, the probability of a 25 basis points Fed rate hike in June is less than 10%.

Analysts at Rabobank see the US central bank resuming the hiking cycle in July:

“Given Powell’s bias toward a pause in June, we expect the FOMC to keep the target range for the federal funds rate unchanged this month.”

“However, because of the reacceleration of the economy, and the modest impact of the banking turmoil on credit conditions, we now expect the FOMC to resume the hiking cycle in July in order to get inflation under control. For now, we expect one rate hike of 25 bps, followed by a longer pause, at least through the end of the year.”

Federal Reserve interest rate decision: What to know in markets on Wednesday, June 14

- The US Dollar Index, which tracks the USD’s performance against a basket of six major currencies, continues to decline heading into the Fed decision, reflecting a broad USD weakness.

- The benchmark 10-year US Treasury bond yield dropped below 3.7% with the initial reaction to the US inflation data but recovered toward 3.8% on Wednesday.

- Wall Street’s main indexes closed in positive territory on Tuesday. The S&P 500 Index reached its highest level since late April above 4,300.

- On Thursday, the US Census Bureau will release Retail Sales report for May. The Fed’s Industrial Production will also be featured in the US economic docket alongside the weekly Initial Jobless Claims data this week.

- The European Central Bank (ECB) is expected to hike its key rates by 25 bps.

- On a monthly basis, the Producer Price Index (PPI) in the US declined 0.3% in May. The annual producer inflation fell to 1.1% from 2.3% in April.

When is the Fed meeting and how could it affect EUR/USD?

The Federal Reserve is scheduled to announce its interest rate decision and publish the revised Summary of Economic Projections (SEP), the so-called dot plot, this Wednesday, June 14, at 18:00 GMT. This will be followed by the post-meeting FOMC press conference at 18:30 GMT. Investors expect the Fed to leave the policy rate unchanged but see a strong probability for at least one more rate hike this year.

Following the collapse of several mid-sized banks in the United States, the Fed unexpectedly changed its policy language in March and said “some additional policy firming” may be appropriate to bring down inflation, dropping the reference to “ongoing increases.” In May, the Fed raised its policy rate by 25 basis points (bps) to the range of 5%-5.25%. In the ensuing press conference, FOMC Chairman Jerome Powell acknowledged that it was difficult to predict how much credit tightening will replace the need for any further rate hikes. Powell, however, reiterated that it would not be appropriate to cut rates later in the year, given the view that inflation will take some time to come down.

In March, the Fed’s SEP showed that the median view of the policy rate at end-2023 stood at 5.1%, matching December’s projection. The publication further revealed that policymakers saw a slower Gross Domestic Product (GDP) growth in 2023, alongside lower unemployment and less progress on inflation than they saw in December. Finally, projections pointed to a total of 75 bps of rate cuts in 2024.

Unless the Fed delivers a significant hawkish surprise by going against the market expectation and raising the interest rate by 25 bps, the US Dollar’s performance is likely to be effected by the terminal rate projection in the dot plot, which can confirm whether the Fed leaves the door open to additional rate hikes even if the policy rate is left unchanged in June.

Previewing the Fed event, “we still think the bar for restarting hikes in July will be high unless inflation pressures clearly accelerate over summer, which we consider unlikely,” said analysts at Danske Bank. “We make no changes to our forecasts, and expect the Fed to maintain rates at the current level for the remainder of the year. A pause could pose near-term upside risks to EUR/USD, but we still maintain a bearish view on the cross towards H2.”

Eren Sengezer, European Session Lead Analyst at GSR, shares his outlook for EUR/USD: “A 25 bps Fed rate hike or a terminal rate projection above 5.5% could trigger a decisive rally in the US Dollar and weigh heavily on EUR/USD. On the flip side, a no change in the policy rate combined with a downward revision to end-2024 rate projection could provide a boost to the pair. Market participants will also pay close attention to Powell’s comments. If Powell mentions that credit tightening is less severe than initially feared, that could be seen as a hawkish tone, helping USD stay resilient against its rivals and vice versa. On the other hand, the USD is likely to come under selling pressure in case Powell sounds concerned about the economic activity losing momentum.”

“The near-term technical outlook is yet to show a convincing bullish sign. The Relative Strength Index (RSI) indicator on the daily chart stays slightly above 50 and EUR/USD failed to make a daily close above the 100-day Simple Moving Average (SMA), currently located at 1.0800, despite having climbed above this level on Tuesday.”

“In case the pair confirms 1.0800 as support, it is likely to face resistance at 1.0860 (Fibonacci 50% retracement) before targeting 1.0900 (psychological level, Fibonacci 61.8% retracement) and 1.0960 (static level from early April).”

“On the downside, EUR/USD could slide toward 1.0750 (Fibonacci 23.6% retracement) and 1.0700 (psychological level, static level) if it returns below 1.0800,” Eren explains.

United States Fed Interest Rate Decision

With a pre-set regularity, a nation’s central bank has an economic policy meeting, in which board members took different measures, the most relevant one being the interest rate that it will charge on loans and advances to commercial banks. In the US, the Board of Governors of the Federal Reserve meets at intervals of five to eight weeks, in which they announce their latest decisions. A rate hike tends to boost the US dollar, as it is understood as a sign of healthy inflation. A rate cut, on the other hand, is seen as a sign of economic and inflationary woes and, therefore, tends to weaken the USD. If rates remain unchanged, attention turns to the tone of the FOMC statement, and whether the tone is hawkish, or dovish over future developments of inflation.

United States Fed Interest Rate Decision is taking place on Wednesday, June 14 th at 18:00 GMT.

The consensus for the next United States Fed Interest Rate Decision is 5.25, and the last deviation was non-existant.

Interest rates are what central banks charge to their domestic banks to borrow money. Although central banks also use rates as a tool to stabilize the economy. Lower rates are meant to provide cheaper financial costs to banks that should be translated to businesses and are usually used to stimulate the economy, usually useful in the low inflation scenario. However, mounting inflationary pressures are usually seen as an indication of a booming economy and result in higher bank rates, to prevent inflation from running out of control. In the US, the Federal Reserve is in charge of the monetary policy.