The Relative Strength Index (RSI) is one of the most powerful and widely-used technical indicators in the Indian stock market. Whether you’re trading Nifty, Bank Nifty, or individual stocks, understanding RSI can significantly improve your trading decisions and help you identify profitable entry and exit points.

- 1 What is RSI (Relative Strength Index)?

- 2 RSI Formula and Calculation

- 3 Basic RSI Formula

- 4 Step-by-Step Calculation Process

- 5 Real Example Calculation

- 6 RSI Levels and Interpretation

- 7 Traditional RSI Levels

- 8 Advanced RSI Levels for Different Market Conditions

- 9 RSI Settings for Indian Markets

- 10 Optimal RSI Settings by Trading Style

- 11 RSI Trading Strategies

- 12 1. Overbought/Oversold Strategy

- 13 2. RSI 50-Line Crossover Strategy

- 14 3. RSI Divergence Strategy

- 15 Success Rates of Different Divergences

- 16 Common RSI Trading Mistakes to Avoid

- 17 Major RSI Mistakes and Solutions

- 18 How to Avoid These Mistakes

- 19 Advanced RSI Techniques

- 20 RSI with Support and Resistance

- 21 RSI Divergence Trading

- 22 Multi-Timeframe RSI Analysis

- 23 RSI for Indian Stock Market Examples

- 24 Nifty Trading with RSI

- 25 Bank Nifty RSI Strategy

- 26 Individual Stock RSI Trading

- 27 Risk Management with RSI

- 28 Position Sizing with RSI

- 29 Stop-Loss Strategies

- 30 SEO-Optimized Blog Slug

- 31 Conclusion

- 32 Frequently Asked Questions (FAQs)

What is RSI (Relative Strength Index)?

The Relative Strength Index, developed by J. Welles Wilder in 1978, is a momentum oscillator that measures the speed and change of price movements in stocks and other financial instruments. RSI operates on a scale from 0 to 100 and helps traders identify whether a stock is overbought or oversold.

Think of RSI as a speedometer for stock momentum. Just like a car’s speedometer tells you how fast you’re going, RSI tells you how fast a stock’s price is moving up or down. This makes it incredibly valuable for Indian traders looking to time their entries and exits in volatile market conditions.

RSI Formula and Calculation

The RSI calculation might seem complex, but understanding it helps you use the indicator more effectively. Here’s the step-by-step process:

Basic RSI Formula

RSI = 100 – [100 / (1 + RS)]

Where RS (Relative Strength) = Average Gain / Average Loss

Step-by-Step Calculation Process

- Calculate daily price changes – Compare today’s closing price with yesterday’s closing price

- Separate gains and losses – Positive changes go to gains, negative changes (as positive numbers) go to losses

- Calculate average gains and losses – Usually over 14 periods (days/candles)

- Find RS – Divide average gain by average loss

- Apply RSI formula – Use the formula above to get the final RSI value

Real Example Calculation

Let’s say a stock had these changes over 14 days:

- Average Gain: ₹2.14 per day

- Average Loss: ₹0.71 per day

- RS: 2.14 ÷ 0.71 = 3.01

- RSI: 100 – [100 ÷ (1 + 3.01)] = 75.06

Since RSI = 75.06 > 70, this indicates an overbought condition where the stock might be due for a correction.

RSI Levels and Interpretation

Understanding RSI levels is crucial for making profitable trading decisions in the Indian market:

Traditional RSI Levels

- Above 70: Overbought – Stock may be overvalued, consider selling

- Below 30: Oversold – Stock may be undervalued, consider buying

- Around 50: Neutral – Balanced market conditions

Advanced RSI Levels for Different Market Conditions

| Market Condition | Overbought Level | Oversold Level | Best Use Case |

|---|---|---|---|

| Strong Trending Market | 80 | 20 | Nifty in strong bull/bear trend |

| Normal Market | 70 | 30 | Regular stock trading |

| Range-Bound Market | 65 | 35 | Sideways moving stocks |

| High Volatility | 75 | 25 | Bank Nifty, IT stocks |

RSI Settings for Indian Markets

The effectiveness of RSI largely depends on using the right settings for different trading styles and timeframes:

Optimal RSI Settings by Trading Style

| Trading Style | RSI Period | Timeframe | Overbought/Oversold | Best For |

|---|---|---|---|---|

| Scalping | 5-7 | 1-5 min | 80/20 | Quick intraday profits |

| Day Trading | 9-10 | 15-30 min | 75/25 | Same-day position trades |

| Swing Trading | 14 | 4H-Daily | 70/30 | Multi-day positions |

| Position Trading | 21-28 | Daily-Weekly | 65/35 | Long-term investments |

For 15-minute charts popular among Indian day traders, use RSI period of 7-10 with levels 75/25 for better signal quality and fewer false signals.

RSI Trading Strategies

1. Overbought/Oversold Strategy

This is the most basic but effective RSI strategy:

Buy Signal: When RSI crosses above 30 from oversold territory

Sell Signal: When RSI crosses below 70 from overbought territory

Important: Don’t buy/sell immediately when RSI hits 30/70. Wait for it to cross back for confirmation.

2. RSI 50-Line Crossover Strategy

The 50-level acts as a momentum confirmation tool:

- RSI above 50: Bullish momentum, consider long positions

- RSI below 50: Bearish momentum, consider short positions

This strategy works excellently with Nifty and Bank Nifty trends.

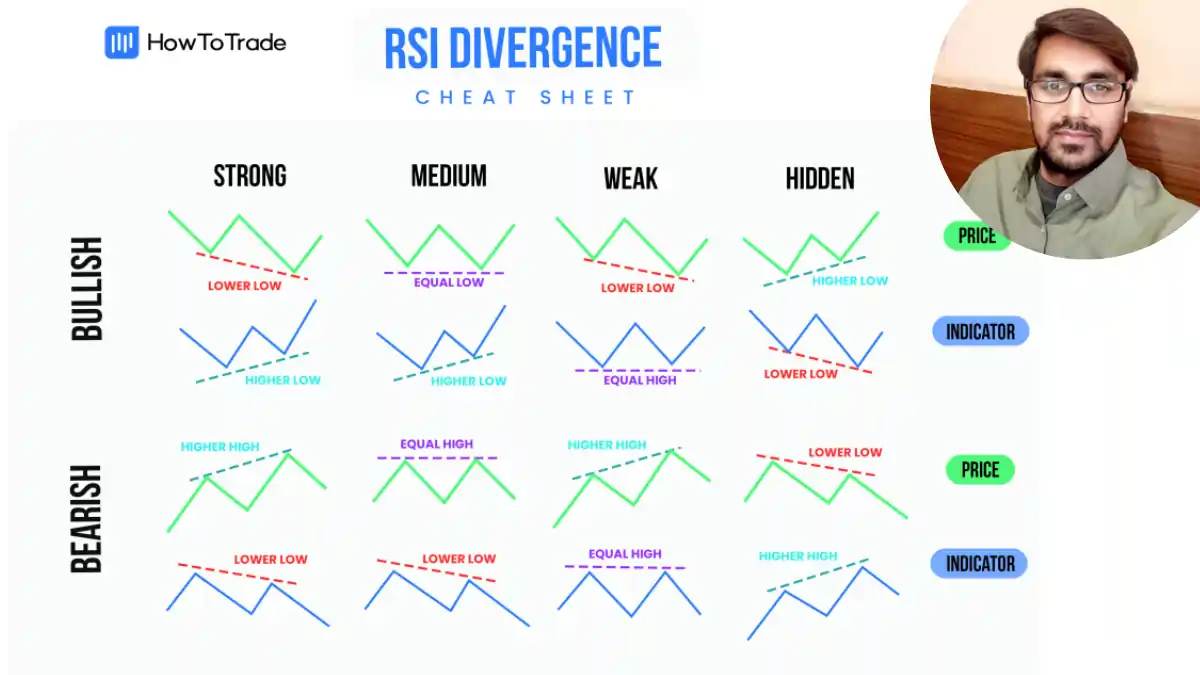

3. RSI Divergence Strategy

Divergence is one of the most powerful RSI signals, offering early warnings of trend reversals:

Types of RSI Divergence

Bullish Divergence: Price makes lower lows, but RSI makes higher lows – signals potential upward reversal

Bearish Divergence: Price makes higher highs, but RSI makes lower highs – signals potential downward reversal

Hidden Divergence: Signals trend continuation rather than reversal

Success Rates of Different Divergences

- Bullish Regular Divergence: 68% success rate

- Bearish Regular Divergence: 72% success rate

- Hidden Divergences: 75-78% success rate

Common RSI Trading Mistakes to Avoid

Many Indian traders make these costly mistakes when using RSI:

Major RSI Mistakes and Solutions

| Mistake | Impact on Success | Solution | Indian Market Context |

|---|---|---|---|

| Using RSI alone | -45% success rate | Combine with volume, moving averages | Essential for Nifty’s volatility |

| Ignoring market trends | -38% success rate | Check overall market direction | Critical during sector rotations |

| Wrong timeframe settings | -32% success rate | Adjust settings for your timeframe | Different for equity vs futures |

| Trading against strong trends | -42% success rate | Trade with the trend direction | Very important in trending Indian markets |

| Fixed levels for all stocks | -25% success rate | Customize levels based on volatility | Bank Nifty needs different levels than IT stocks |

How to Avoid These Mistakes

- Never rely on RSI alone – Always confirm with price action, volume, or support/resistance levels

- Respect the trend – Don’t fight strong trends even if RSI shows extreme readings

- Customize your settings – Adjust RSI parameters based on the stock’s volatility and your trading timeframe

- Wait for confirmation – Don’t jump on RSI signals immediately; wait for price confirmation

Advanced RSI Techniques

RSI with Support and Resistance

Combining RSI with key support and resistance levels significantly improves signal reliability:

- RSI oversold + price at support = Strong buy signal

- RSI overbought + price at resistance = Strong sell signal

RSI Divergence Trading

For successful divergence trading:

- Identify the divergence pattern clearly

- Wait for confirmation through candlestick patterns or volume

- Set proper stop-losses using ATR (Average True Range)

- Use multiple timeframe analysis – Daily for trend, 4H for setup, 1H for entry

Multi-Timeframe RSI Analysis

Professional traders use this approach:

- Daily timeframe: Determine overall trend direction

- 4-hour timeframe: Identify setup opportunities

- 1-hour timeframe: Time precise entries

RSI for Indian Stock Market Examples

Nifty Trading with RSI

- Use RSI(14) with 70/30 levels for swing trading

- For intraday Nifty futures, use RSI(9) with 75/25 levels

- Combine with volume analysis during market opening and closing hours

Bank Nifty RSI Strategy

Bank Nifty is highly volatile, so:

- Use RSI(10) with 80/20 levels for better signals

- Pay special attention to RSI divergences during result seasons

- Combine with VIX levels for additional confirmation

Individual Stock RSI Trading

- IT stocks: Use standard RSI(14) with 70/30 levels

- Banking stocks: Use RSI(10) with 75/25 levels due to higher volatility

- Pharma stocks: RSI(14) with 65/35 levels work well for swing trades

Risk Management with RSI

Position Sizing with RSI

- Strong RSI signals: Use 2-3% risk per trade

- Weak RSI signals: Use 1% risk per trade

- Divergence trades: Use wider stops but smaller position sizes

Stop-Loss Strategies

- ATR-based stops: Use 1.5 × ATR for swing trades

- Support/Resistance stops: Place stops beyond key levels

- RSI-based stops: Exit if RSI fails to confirm your trade direction

SEO-Optimized Blog Slug

For maximum Google ranking potential, use this slug:/rsi-indicator-guide-indian-stock-market-trading-strategies

This slug includes primary keywords (RSI indicator, Indian stock market) and is under 60 characters for optimal SEO performance.

Conclusion

The Relative Strength Index is an invaluable tool for Indian traders when used correctly. Remember these key points:

- Combine RSI with other indicators – Never trade on RSI signals alone

- Customize settings for your trading style and market conditions

- Focus on divergences for early trend reversal signals

- Respect market trends – Don’t fight strong trends even with extreme RSI readings

- Practice proper risk management – Use appropriate position sizes and stop-losses

Whether you’re trading Nifty, Bank Nifty, or individual stocks, mastering RSI will significantly improve your trading performance in the Indian markets. Start with the basic strategies, practice with paper trading, and gradually incorporate advanced techniques as you gain experience.

Remember: RSI is a tool, not a crystal ball. Use it wisely with proper risk management for consistent trading success.

Frequently Asked Questions (FAQs)

1. What is the best RSI setting for Indian stock market?

For most Indian stocks, RSI(14) with 70/30 levels works best for swing trading. However, for volatile stocks like Bank Nifty, use RSI(10) with 80/20 levels. Day traders should use shorter periods like RSI(7-9) for faster signals.

2. Should I buy immediately when RSI goes below 30?

No, never buy immediately. Wait for RSI to cross back above 30 as confirmation. Many stocks can stay oversold for extended periods, especially in strong downtrends. Always combine RSI with price action and volume confirmation.

3. What’s the difference between RSI and Stochastic oscillator?

RSI measures price momentum using closing prices only, while Stochastic compares closing price to the high-low range. RSI is less volatile and gives clearer signals, making it better for beginners. Stochastic is more sensitive but generates more false signals.

4. Why doesn’t RSI work during strong trends?

During strong trends, RSI can remain in overbought (>70) or oversold (<30) zones for extended periods. This is normal market behavior. Don’t fight the trend – instead, use RSI as a tool to find better entry points within the trend direction.

5. Can RSI predict exact market tops and bottoms?

No indicator can predict exact tops and bottoms, including RSI. RSI helps identify potential reversal zones, but you need confirmation from price action, volume, and other technical factors. Use RSI as a guide, not a crystal ball.