Spot Gold Short Term Outlook : Above $1785 the two key targets are the contract high at $1796 and an up-trending at $1800 level. Crossing to the strong side of the up-trending Gann angle will put gold in an extremely bearish position.

gold forex symbol

Gold Silver Boom Boom, Told you Market Ready for Big Blast – Gold High 45724 Full Target

Gold Silver Boom Boom, Told you Market Ready for Big Blast – Gold High 45724 Full Target Hit

Should you Buy Gold Now?

Precious metals too have seen massiveintraday movements and virusrelated panic have forced investors to raise cash by selling gold and silver.

Spot Gold Below $1513 Target $1482—$1458 – Neal Bhai

GOLD PRICE REBOUNDS FROM KEY PRICE ZONE AS FED DEPLOYS CREDIT FACILITY – The price of gold may extend the rebound from the monthly low ($1451) as the Federal Reserve establishes a Primary Dealer Credit Facility (PDCF), with the operations to “offer overnight and term funding with maturities up to 90 days.”

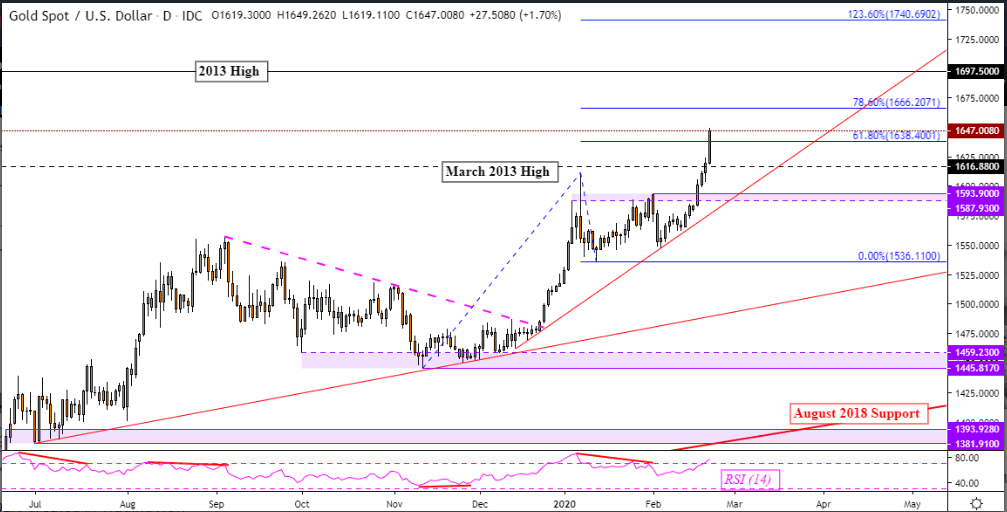

Gold Technical Forecast is Clearly Bullish

The gold technical forecast is clearly bullish from a medium-term perspective. Price action in the week ahead could determine if that forecast is at risk and it will be important to watch a couple of key technical barriers.

Gold $1580—$1585 Zone is an Important Resistance Zone

Gold Price Update – The market is forming a base near the $1548 level and the 200 SMA on the four-hour chart. The bulls would need a clear break above the $1,580—$1,585 resistance zone to re-establish the upward bias.

Gold Prices Start New Bull run, Target $1,700 ounce

Gold prices is en route to test $1,800 and its rally are unnerving Dow Jones investors. The price of gold has spiked 7.5% within three weeks since late December and its strong rally is unnerving investors in the U.S. stock market.

Gold Seller Trap, Refreshes multi-year Top to cross $1606.12 Amid Calls of Iran Attacks

Markets are now rushing to risk-safety but will also keep eyes on the US President Trump for further direction, Gold extends its northward trajectory to the levels last seen in April 2013.

PRECIOUS METALS VOLATILITY KEEPS HEADING LOWER, BUT GOLD PRICES ARE NOT….

Precious metals like gold have a relationship with volatility unlike other asset classes. While other asset classes like bonds and stocks don’t like increased volatility – signaling greater uncertainty around cash flows, dividends, coupon payments, etc. – precious metals tend to benefit during periods of higher volatility.

Russia Increase Gold Production more than 185.1 Tons – Gold Silver Reports

Russia increase gold production more than 185.1 tons of the precious yellow metal from January to July this year, according to recent data published by Russia’s Finance Ministry.

![Spot Gold Short-Term Technical Forecast [11 March 2025]](https://www.goldsilverreports.com/wp-content/uploads/2019/01/Gold-bar-5945sdf54@Neal-Bhai-Reports-nbr.jpg)