Gold climbed, recovering from Thursday’s drop, as the dollar sank with investors weighing the impact of the Federal Reserve’s new approach to setting U.S. monetary policy.

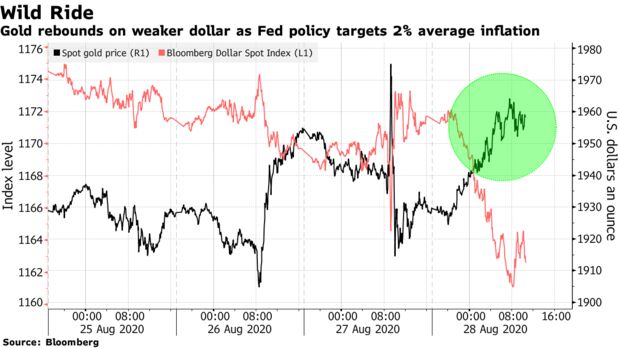

The metal rose the most in almost two weeks and the dollar touched a two-year low a day after Fed Chair Jerome Powell said the central bank will seek inflation that averages 2% over time. His comments sent bullion on a roller-coaster ride in the previous session, as he signaled the central bank will stay accommodative for longer, with a more tolerant approach on inflation, but won’t hesitate to act if consumer prices rise considerably above its goals.

Gold strengthened Friday due to “a more measured appraisal of the shift in Fed nuances, along with a weakening dollar, for the same reason,” Rhona O’Connell, head of market analysis for EMEA and Asia regions at StoneX Group, said in an emailed note.

Higher inflation tolerance and low interest rates should see U.S. real yields fall in the medium-to-longer term, which is supportive for gold, said Vivek Dhar, an analyst at Commonwealth Bank of Australia. Still, the fact that the Fed will also act if there are inflationary pressures adds doubt to how high U.S. 10-year inflation expectations can reach, he said.

Spot gold jumped 1.8% to $1,963.41 an ounce by 1:57 p.m. in New York, heading for its first weekly gain in three weeks. The metal is down more than $100 from a record set earlier this month as risk-on sentiment improved, but it is still one of the best-performing commodities this year after the coronavirus crisis and massive stimulus measures boosted demand for havens. Gold futures for December delivery rose 2.2% to settle at $1,974.90.

The Bloomberg Dollar Spot Index dropped 0.9% to the lowest since May 2018, while U.S. equities rose. Economic confidence in the euro area continued to improve in August, data on Friday showed, but job cuts in recent months across the continent meant consumers remain worried about the labor market. In the U.S., the rebound in consumer spending slowed in July as virus cases rose in some states.

READ MORE

The Fed’s shift to let inflation and employment run higher may signal that policy makers will keep interest rates low for years to come, lifting the appeal of non-interest-bearing gold. There’s still room for bullion to set new all-time highs, although that may take time, said Ole Hansen, head of commodity strategy at Saxo Bank A/S.

Powell’s “speech did not threaten the bullish narrative for gold and silver,” Hansen said. “Low interest rates for longer, a weaker dollar, massive amounts of stimulus and the increased demand for inflation hedges are likely to continue to drive demand for both metals.”

The biggest risk to gold remains the discovery of a vaccine and a sharp correction in stocks, which would spark a drive to raise cash, he said.

Source: Bloomberg