Gold price weekly fundamental forecast : Gold silver prices perked up a bit last week to put an end to their recent string of losses. Gold notched a gain of 1.44% while Silver edged 2.74% higher on balance.

Gold price weekly fundamental forecast

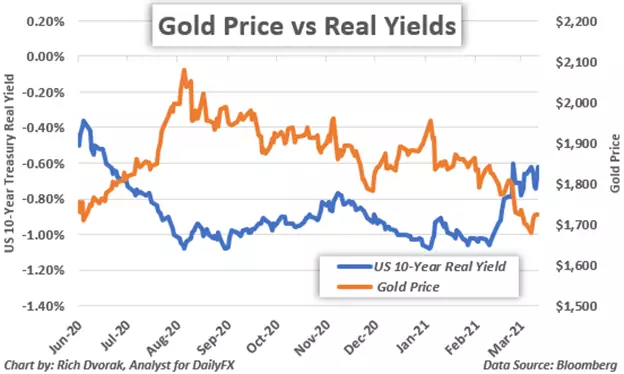

Precious metals likely benefited from a slightly softer US Dollar as the recent surge in real yields paused. Gold price action generally holds a strong inverse relationship with real yields as highlighted by the chart below.

What will happen to interest rates 2021?

That said, gold prices might come back under pressure looking to the week ahead. This is in consideration of the prevailing trend higher in real yields and event risk posed by the upcoming Federal Reserve interest rate decision. The scheduled Fed announcement expected to cross market wires on Wednesday, 17 March at 18:00 GMT will include updated economic projections, which stands to weigh materially on the direction of real yields and gold.

GOLD PRICE CHART WITH 10-YEAR US REAL YIELD OVERLAID: DAILY TIME FRAME (JUN 2020 TO MAR 2021).

Dot plot projections for the target Fed funds rate, in addition to the median inflation forecast provided by FOMC officials, could come under scrutiny in particular. Gold prices might react positively if there is a noteworthy upgrade to core PCE inflation, but this could be offset if the central bank brings forward its next projected rate hike as the latter would likely boost real yields and the US Dollar. Fed Chair Jerome Powell will also spearhead a press conference shortly following the statement release.

Powell might toe the line laid out during his last speech earlier this month, which basically highlighted how the Fed is comfortable with Treasury yields rising as it broadly underpins better outlook for the US economy.

Echoing this message could ignite another selloff across bonds and precious metals. On the other hand, if Fed Chair Powell changes his tune and signals appetite for pushing asset purchases further down the curve to keep a lid on long-term borrowing costs, this would likely provide a much-needed fundamental catalyst to reinvigorate gold bulls.

Gold price action might also gyrate in response to Fed guidance on supplementary leverage ratio requirements for banks. The Fed enabled US banks to expand their balance sheets by temporarily excluding US Treasuries and deposits held with Federal Reserve banks from capital adequacy calculations, which broadly increased SLRs. Signaling a walk-back from this temporary relaxation in capital requirements could hurt demand for US Treasuries, and in turn, push yields higher and gold lower.