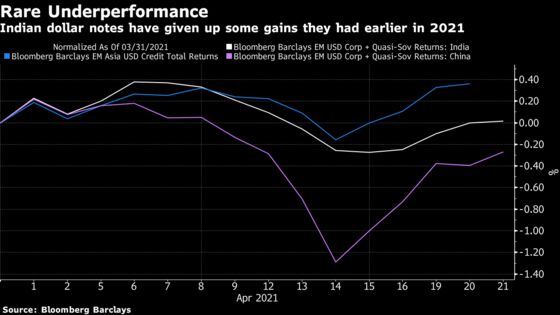

A slide in the rupee prices is exacerbating a slump in Indian corporate dollar notes that are now among the worst performers in Asia, just as concerns mount that companies are hedging less.

- The securities have lost about 0.1% in April, worse than a 0.4% gain for a broader Asian dollar bond gauge. All the other countries in Asia have posted positive returns, except China which lost about 0.4% after the stumble by China Huarong Asset Management Co.

- The weaker rupee pushes up servicing costs on foreign debt. The currency has plunged about 2.4% against the dollar this month, making it Asia’s worst-performer. Spiking Covid-19 cases threaten to worsen the selloff

- About 5 out of 10 Indian firms hedge their foreign borrowings in India as compared to about 8 several years ago before the RBI eased rules on hedging, said Samir Lodha, chief executive officer at QuantArt Market Solutions, a Mumbai-based advisory firm. “The drop in the rupee this month may prompt more local companies with foreign borrowings to consider at least some low-cost hedging.”

Primary Market — Foreign Borrowings Slow

Rupee prices Fall Is Hurting Bonds

- The weaker rupee is also making borrowers hesitate to tap what would otherwise be some of the lowest borrowing costs ever in the dollar bond market. Just one Indian company has settled a note this month: a $585 million deal from ReNew Power. That leaves issuance set for the lowest in six months

- Local firms have also shunned foreign-currency loans in April after borrowings of $7.2 billion in the previous quarter

- “Most corporates will definitely pause their plans to issue fresh foreign-currency debt as they wait for the rupee to stabilize,” said Abhishek Goenka, founder of IFA Global, a Mumbai-based advisory firm. “Pandemic-induced currency volatility is making it difficult for borrowers to assess their foreign debt costs.”

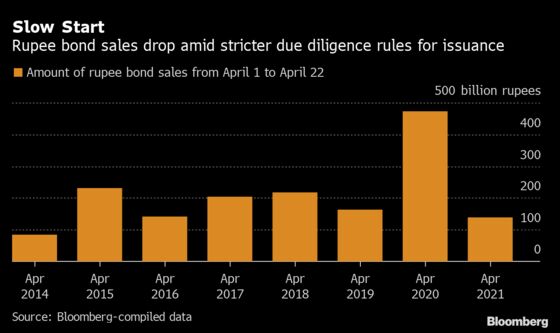

- Firms may be turning more to the local credit market, even though there have been fresh obstacles there too

- They sold 47.6 billion rupees of bonds this week and still plan as much as 80.5 billion rupees more. If all those sales go through, that would be higher than in the previous two weeks combined

- Still, offerings have fallen to 139.9 billion rupees ($1.9 billion) this month, the slowest start to a financial year since 2014. That’s due in part to rules that took effect April 1 strengthening the role of trustees for secured bonds backed by assets

Secondary Market — Sovereign Rating Concerns

- The latest wave of coronavirus infections is also bad for India’s sovereign rating. The country has the lowest investment-grade score with a negative outlook at Moody’s Investors Service and Fitch Ratings

- “We expect a repeat of 2020’s sudden crash in economic activity in the coming months,” said Timothy Wee Lee Tan and Jason Lee, Bloomberg Intelligence analysts. “With a downgraded GDP growth outlook for FY22, India’s debt burden will be higher than the current IMF forecast, implying an elevated risk of ratings falling into speculative grade.”

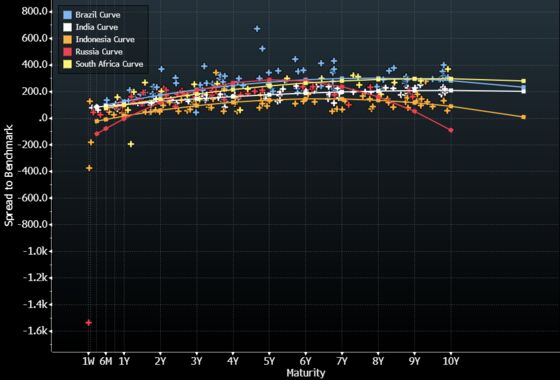

- Any official gross domestic product downgrade may lead to pre-emptive widening of the option-adjusted spread for Indian dollar credits, with an actual offshore sovereign rating downgrade likely to push premiums up to 90 basis points wider to trade closer to Brazil and South Africa, according to Bloomberg Intelligence

Distressed Debt – ARC Rules Under Review

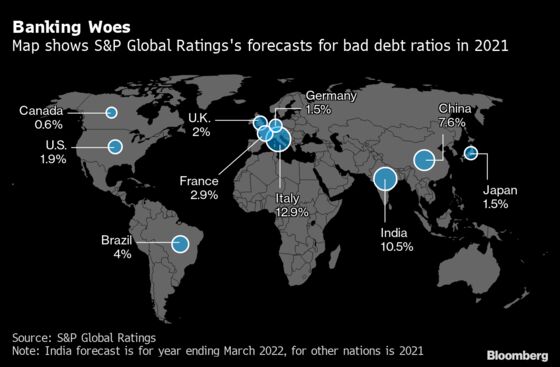

- Reserve Bank of India formed a six-member panel Monday to review rules for Asset Reconstruction Companies or ARCs, which help India’s banking system deal with one of the world’s worst bad loan ratios among major economies

- ARCs have been in the spotlight in recent weeks:

- Mar. 18: India’s Ministry of Corporate Affairs is investigating allegations of financial irregularities at the asset reconstruction arm of Edelweiss Financial Services Ltd., according to people with direct knowledge of the matter. Edelweiss said it hasn’t received any intimation of any inspection by the ministry

- Mar. 14: India’s central bank has rejected Yes Bank Ltd.’s proposal to set up an ARC for acquiring bad loans on conflict of interest concerns, Mint reported citing people it didn’t identify

- Meanwhile, Infrastructure Leasing & Financial Services, whose default in 2018 triggered a prolonged credit crisis in the country, plans to resolve 500 billion rupees ($6.6 billion) of its debt by the end of September, Chairman Uday Kotak said last week. Investors are closely watching the debt resolution as a test case for group insolvency

- Kotak, who is heading the IL&FS board after government seized control of the shadow lender in 2018, expects to resolve about 62% of its 1 trillion rupees of debt

- Another group facing challenges in servicing its debt is Future Group. The Indian supermarket-operator Future Retail Ltd. approved a debt resolution plan that eases some immediate concerns as a legal battle with partner Amazon.com Inc. threatens to delay an asset sale to Reliance Industries Ltd. India’s top court scheduled a final hearing in the matter to May 4

Best and Worst Performing Corporate Dollar Bonds Last 12 Months

| Best Performers | Return (%) |

|---|---|

| Vedanta Resources due April 2026 | +16.6 |

| Tata Motors due May 2025 | +2.8 |

| ABJA Investment due July 2024 | +1.1 |

| Worst Performers | Return (%) |

|---|---|

| Indian Railway Finance due Feb. 2030 | -7.7 |

| Delhi International Airport due June 2029 | -6.0 |

| Future Retail due Jan. 2025 | -5.3 |

(With Agency Inputs)