Copper supply and production costs: Copper price mining is primarily focused within South America which can have a large bearing on the price of copper. Shortage of supply, quality of copper and the variations in production costs can all have resultant impacts on price. This leads on to country specific risk which can affect supply due to political instability or work related issues.

In mid 2018, Chilean (worlds largest copper producer) copper workers declared they would strike unless their increased wage demands were met. This significantly manipulated copper prices as the threat of a supply shortage may ensue, causing a surge to multi-year highs at the time (see chart below).

WHAT FACTORS AFFECT THE PRICE OF COPPER?

US Dollar

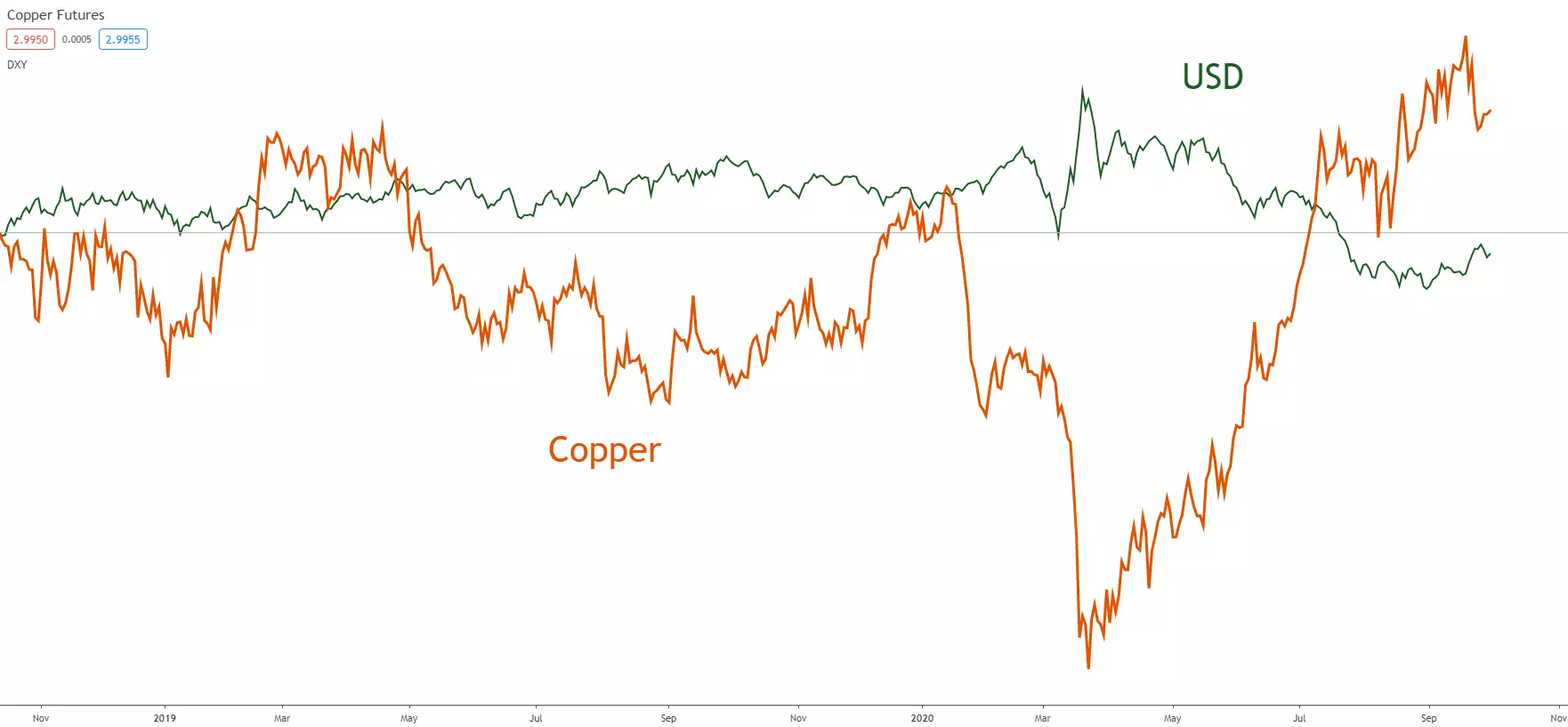

Like many other metals, copper is inversely correlated (see chart below) to the US Dollar which means that when the US Dollar depreciates, copper prices generally rise and vice versa. It is important to note that this relationship is not one-to-one (delta 1) but does carry a high degree of correlation.

The reason why the US Dollar is an influencing factor on copper is because copper is priced in USD. For example, when the Dollar falls, a buyer will have to pay fewer of his/her domestic currency to purchase a specified amount of copper. Therefore, the commodity (copper) becomes cheaper to buy. This tends to cause an increase in demand and ultimately a rise in the price of copper.

Oil

The refining of copper involves melting down the metal to remove impurities. This process is extremely energy exhaustive and accounts for a large portion of overall cost. Oil prices tend follow a similar trajectory to copper (see chart below). This being said, oil prices are affected by many of the same factors as copper which could support the traditional positive relationship. Regardless of specifics it is clearly noticeable that a relationship exists between both copper and oil, which could provide valuable insight into the copper market. Renewable energy sources are growing in popularity which could interrupt the historical price dynamic between copper and oil.

WHY TRADE COPPER AND HOW DOES COPPER TRADING WORK?

One advantage of copper trading is accessibility. Copper is traded through a variety of avenues like futures, options, equities and CFDs. You can also gain exposure to copper via copper ETFs (exchange traded funds) like CPER (United States Copper Index Fund) or JJCB (iPath Series B Bloomberg Copper Subindex Total Return ETN).

Copper is a soft malleable metal with properties like gold and silver. It derives most of its demand from building construction, transportation equipment and electronic products. It is a strong conductor of electricity and heat, and therefore has a wide range of industrial uses which also leads it to trade in high volumes – a good thing for traders because it can lead to reduced spreads and potentially cleaner chart patterns.

Movements in the price of copper are heavily dependent on demand from emerging market economies like China and India. During times of economic growth, these nations demand large quantities of copper, the demand of which helps to increase the metal’s price. Alternatively, during economic downturns demand for copper drops, price tends to fall as well. Traders should be aware of this dynamic when trading copper.

Many copper traders use technical and/or fundamental analysis to inform their trading strategy which helps a trader forecast whether the price of copper will rise or fall. Once a trader is confident in their forecast, he/she can buy or sell copper in an attempt to profit from price movements. In this way, a trading strategy can also help a trader to manage their risk, identify buy and sell signals in the market and set reasonable take-profit and stop-loss levels with aim of positive risk to reward ratios.

(By Neal Bhai Reports / Gold Silver Reports, India)

Comments are closed.